german tax calculator for students

Whoever earns more pays higher contributions. Filing your tax return is worth it.

German Tax Calculator Easily Work Out Your Net Salary Youtube

If your income falls within the second tax bracket and you earn a gross salary of 25000 you are likely to be taxed at a rate of 29 per cent.

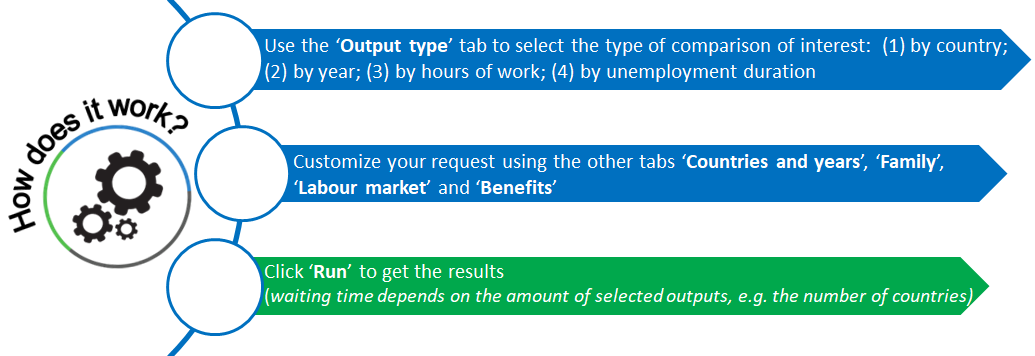

. You can see at a glance what your gross and net income is. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2019. You can enter the gross wage as an annual or monthly figure.

As a student you may earn up to 450 euros a month without having to pay taxes to the state. German Tax Class Calculator. German Wage Tax Calculator Expat Tax.

You want to quickly calculate the probable amount of your income tax when working in Germany. Hundreds of thousands of satisfied customers. The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions.

If you wish to calculate your salary Social Insurance payments and income tax for a differant period please choose an alternate payment period or use the Advanced German Tax Calculator. This year it is 9000 euros. German Income Tax Calculator The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year.

You have to enter both spouses gross salaries and tick the box whether you have children. This Income Tax Calculator is best suited if you only have income as self employed from a trade or from a rental property. The financial year in Germany begins on the 1 st of January and ends on the 31 st of December.

Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income. Try it for free. Millions of euros in tax refunds for.

Online Calculators for German Taxes. Tax Filing In Germany For International Students Quick Facts. Salary Before Tax your total earnings before any taxes have been deducted.

The Federal Central Tax Office Bundeszentralamt für Steuern BZSt offers an income tax calculator which estimates the percentage of income tax you have to pay. If you receive a salary only as an employee on a German payroll you get. For a quick estimation of whether you should consider a tax class change to 3 and 5 you can use this German tax class calculator.

Grossnet Tax Calculator Germany German Wage Calculator. For students there is an annual tax exemption threshold. Student contributions are normally lower.

Germany has a progressive taxation system. Just do your tax return with SteuerGo. What is the tax rate in Germany 2019.

You can expect a high tax refund. The SteuerGo Gross Net Calculator lets you determine your net income. An income up to 450 Euro is exempted from contribution.

File your tax returns at the local tax office based on your place of residence in Germany. Youll then get a breakdown of your total tax liability and take-home pay. Working student wage calculator Germany.

German Income Tax Calculator Expat Tax. You are required to file a tax return. You will most likely get a very high tax refund.

The German Annual Income Tax Calculator for the 2022. This is almost 358 Euro more than the same postdoc but on Lohnsteuerklasse I. In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis.

If you are paid a wage every month on a mini-job basis then you can earn up to 5400 euros a year. 2022 2021 and earlier. As a working student you enjoy a special status that exempts you from some taxes.

If you only have income as self employed from a trade or from a rental property you will get a more accurate. Our salary calculator offers you the possibility to calculate your working student salary quickly and easily. German Grossnet Calculator Wage Calculator for Germany.

The last date for filing for taxes in Germany for the tax year of 2018 is on the 31 st of May. Also known as Gross Income. It is in German but pretty self-explanatory.

Easily calculate various taxes payable in Germany. This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2019. In this case the monthly net-salary after tax is 300934 Euro.

Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. Hope that will help you to understand all you need to know about PhD students and Postdocs salary in Germany in 2020. This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll.

As of an income of 850 Euro per month students pay the full share of 945. Save your German Income Tax Calculation for later use. The tax rate starts at 14 rising in a series of income tax brackets to 45 for the highest earners over 265327.

Use our income tax calculator to calculate the tax burden resulting from your taxable income. With an income of between 450 and 850 Euro per month or more than 20 working hours per week the amount is reduced. Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit payroll information select different tax states etc.

The minimum taxable income is 9169 no tax is charged under this amount.

German Income Tax Calculator Expat Tax

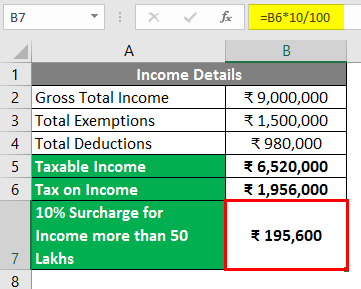

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Foreigner S Income Tax In China China Admissions

Germany Taxing Wages 2021 Oecd Ilibrary

Excel Formula Income Tax Bracket Calculation Exceljet

Us Income Tax Calculator March 2022 Incomeaftertax Com

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Tax In Germany For Expat Employees Expatica

What Are Marriage Penalties And Bonuses Tax Policy Center

German Tax Calculator Easily Work Out Your Net Salary Youtube

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Foreigner S Income Tax In China China Admissions

German Income Tax Calculator Expat Tax

Germany Corporation Tax Calculator 2022

How To Create An Income Tax Calculator In Excel Youtube