tempe az sales tax calculator

However you may need either a Transaction Privilege Tax License aka TPT or sales tax license and a Tempe Regulatory License. Pinal County 72 percent.

2021 Arizona Car Sales Tax Calculator Valley Chevy

Fast Easy Tax Solutions.

. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state. Title 42 Chapter 5 Article 10 with collecting the excise tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Cochise County 61 percent. A The tax rate shall be at the amount equal to one and eight-tenths percent 180 of the gross income from the business activity upon every person engaging or continuing in the business of selling tangible personal property at retail. Apply or Renew on the Accela Citizen AccessACA Portal.

The current total local sales tax rate in Tempe AZ is 8100. US Sales Tax Rates AZ Rates Sales Tax Calculator Sales Tax Table. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112.

The County sales tax rate is. You can use our Arizona Sales Tax Calculator to look up sales tax rates in Arizona by address zip code. Did South Dakota v.

Avalara provides supported pre-built integration. This is the total of state county and city sales tax rates. Sales tax in Tempe Arizona is currently 81.

85280 85281 85282. Tempe Junction AZ Sales Tax Rate. When combined with the state rate each county holds the following total sales tax.

You can find more tax rates and allowances for Tempe and Arizona in the 2022 Arizona Tax Tables. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. Most transactions of goods or services between businesses are not subject to sales tax.

The Tempe Sales Tax is collected by the merchant on all qualifying sales made within Tempe. The December 2020 total local sales tax rate was also 8100. If this rate has been updated locally please contact us and we will update the sales tax rate for Tempe Arizona.

Find your Arizona combined state and local tax rate. The average sales tax rate in Arizona is 7695. Tolani Lake AZ Sales Tax Rate.

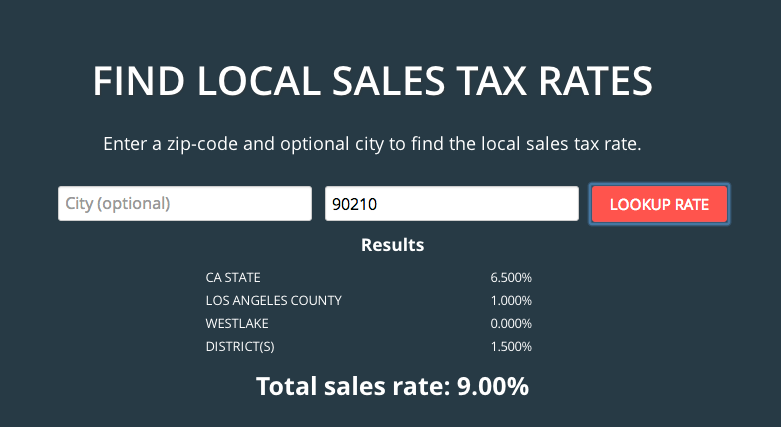

Three Points AZ Sales Tax Rate. Sales Tax Calculator Sales Tax Table. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Arizona local counties cities and special taxation.

AZ is in Maricopa County. The current total local sales tax rate in Tempe Junction AZ is 6300. Free sales tax calculator tool to estimate total amounts.

Groceries are exempt from the Tempe and Arizona. Tempe AZ 85280 salestaxtempegov. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

The December 2020 total local sales tax rate was also 6300. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tempe AZ. The Arizona sales tax rate is currently.

The Tempe Arizona sales tax rate of 81 applies to the following seven zip codes. The Arizona sales tax rate is currently. City Hall 31 E.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Temple Bar Marina AZ Sales Tax Rate. Thatcher AZ Sales Tax Rate.

Ad Find Out Sales Tax Rates For Free. The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Tempe local sales taxesThe local sales tax consists of a 070 county sales tax and a 180 city sales tax. Modify Section 16-460a entitled Retail Sales.

Maricopa County 63 percent. The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223. Greenlee County 61 percent.

The base state sales tax rate in Arizona is 56. Method to calculate Tempe Camp sales tax in 2021. Tempe AZ Sales Tax Rate.

The Tempe sales tax rate is. Arizona sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. As of 2020 the current county sales tax rates range from 025 to 2.

Object Moved This document may be found here. Wayfair Inc affect Arizona. SalesTaxHandbook visitors qualify for a free month by signing up via our partner program here.

Gila County 66 percent. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. Arizona has a 56 statewide sales tax rate but also has 80 local tax jurisdictions including.

The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223. The minimum combined 2022 sales tax rate for Tempe Arizona is. Apache County 61 percent.

Tempe in Arizona has a tax rate of 81 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tempe totaling 25. Local tax rates in Arizona range from 0 to 56 making the sales tax range in Arizona 56 to 112.

Arizona Sales Tax Small Business Guide Truic

Property Taxes In Arizona Lexology

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

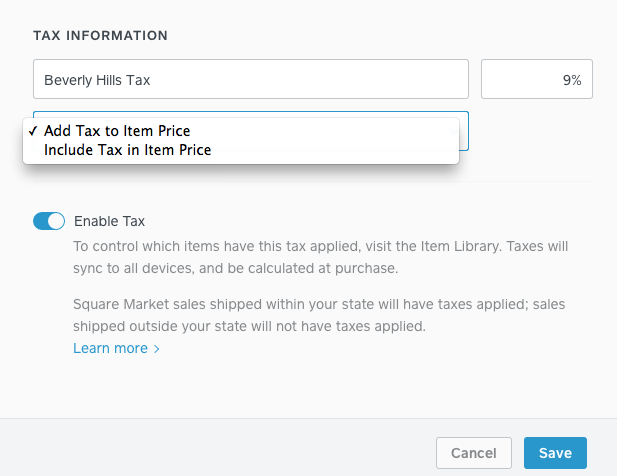

How To Collect Sales Tax Through Square Taxjar

How To Collect Sales Tax Through Square Taxjar

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Arizona Sales Tax Small Business Guide Truic

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Tpt Tutorials Arizona Department Of Revenue

Arizona Sales Tax Rates By City County 2022

Location Based Reporting Arizona Department Of Revenue

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az